Making SMB Payments Visible and Verifiable

Credeity transforms vendor payment behavior into verified business credit - helping SMBs access financing and helping vendors improve cash flow and reduce risk.

How It Works

A simple 3-step process to make SMB payments visible and verifiable

(QuickBooks, Xero, Sage, CSV)

Automated validation + data cleaning

Credeity identifies duplicates, normalizes vendor names,

matches EINs, and validates payment timestamps

Bureau-ready tradelines

Verified payment histories are transformed into compliant

business credit tradelines and transmitted to bureaus.

1

Vendors Connect Their Payment Accounts

Vendors securely sync their payment systems, allowing Credeity to read verified payment

behavior—not full banking data. This protects privacy while enabling accurate, real-time insights into

how vendors manage payments.

2

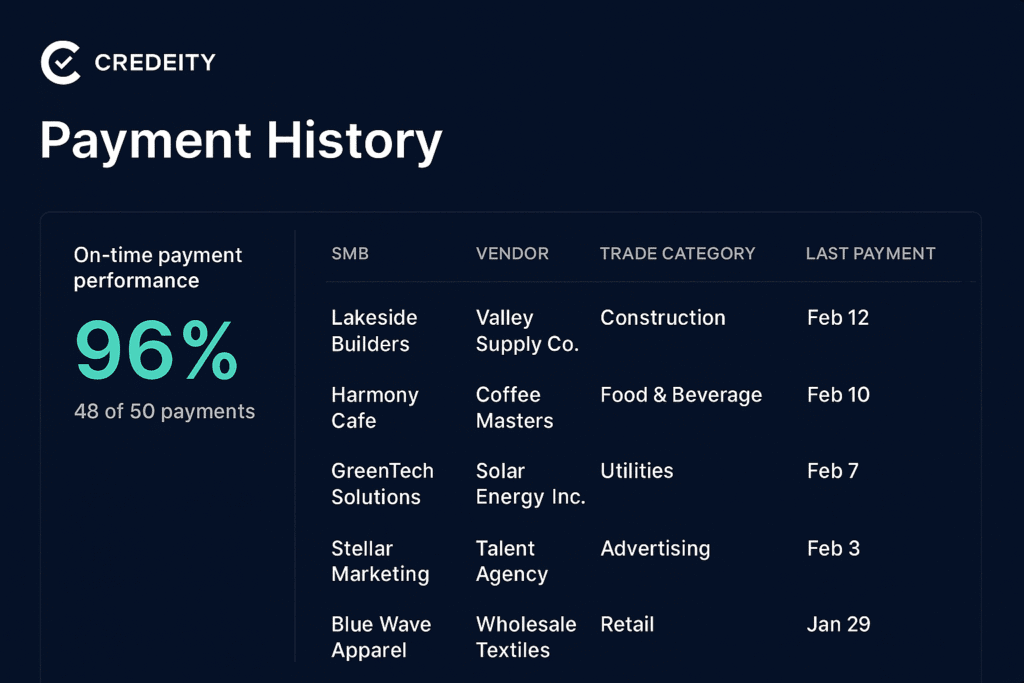

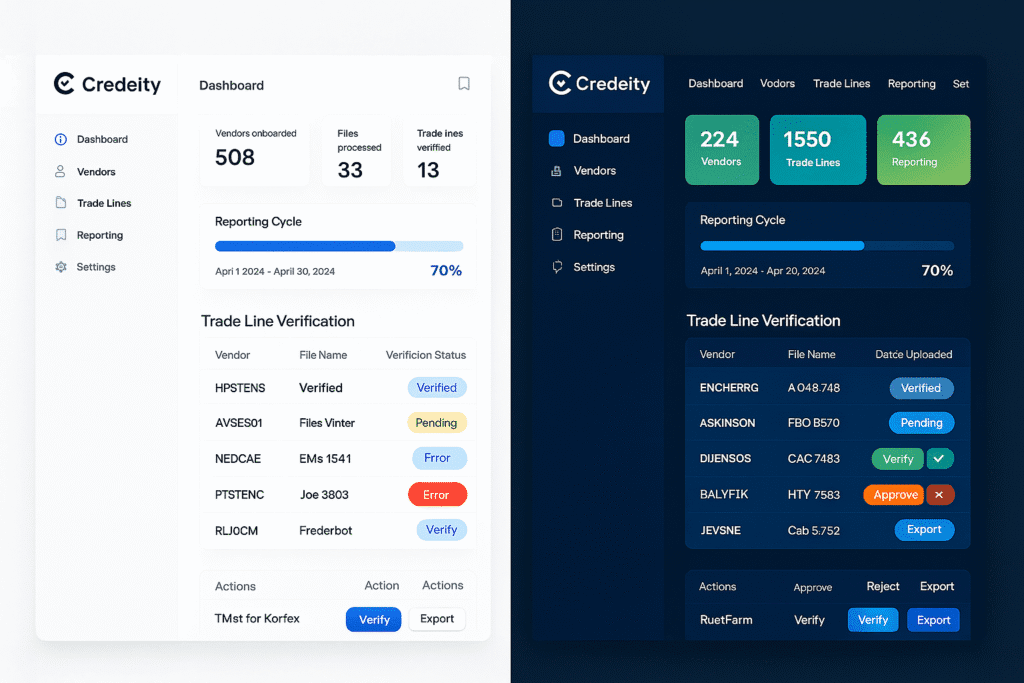

Credeity Verifies Payment Reliability

Credeity analyzes invoice timing, payment consistency, and historical payment patterns to create a

continuously updated reliability profile for each vendor. These insights are standardized so SMBs can

understand vendor behavior at a glance.

3

SMBs Gain Visibility Into Vendor Reliability

SMBs receive Credeity-verified reliability signals that help them understand expected vendor

performance, anticipate potential risks, and operate with greater confidence—even when vendors are

predetermined.

Vendor Benefits

A faster path to trust, visibility, and new business opportunities for vendors.

Faster Onboarding With SMBs

SMBs can instantly see verified reliability signals, allowing vendors to get approved and onboarded much faster—with fewer delays and fewer manual checks.

Increased Trust & Credibility

Verified payment behavior helps vendors demonstrate reliability, strengthen their reputation, and stand out in competitive bidding environments.

Visibility Into Their Own Performance

Vendors gain insights into their payment patterns, helping them understand their strengths, identify inconsistencies, and operate with greater financial discipline.

Access to More Opportunities

Vendors with strong verified profiles gain access to more SMB engagements and contracts where trust and proven performance are required.

No Extra Work Required

Vendors simply connect their existing payment accounts—Credeity verifies everything automatically without additional tools or reporting.

SMB Benefits

Visibility and confidence even when working with vendors - even when they're predetermined.

Reduced Operational Risk

SMBs receive Credeity-verified reliability insights that help them anticipate vendor performance and reduce unexpected disruptions.

Faster Vendor Onboarding

Verified reliability signals streamline internal approvals, allowing SMBs to onboard vendors faster with fewer manual checks.

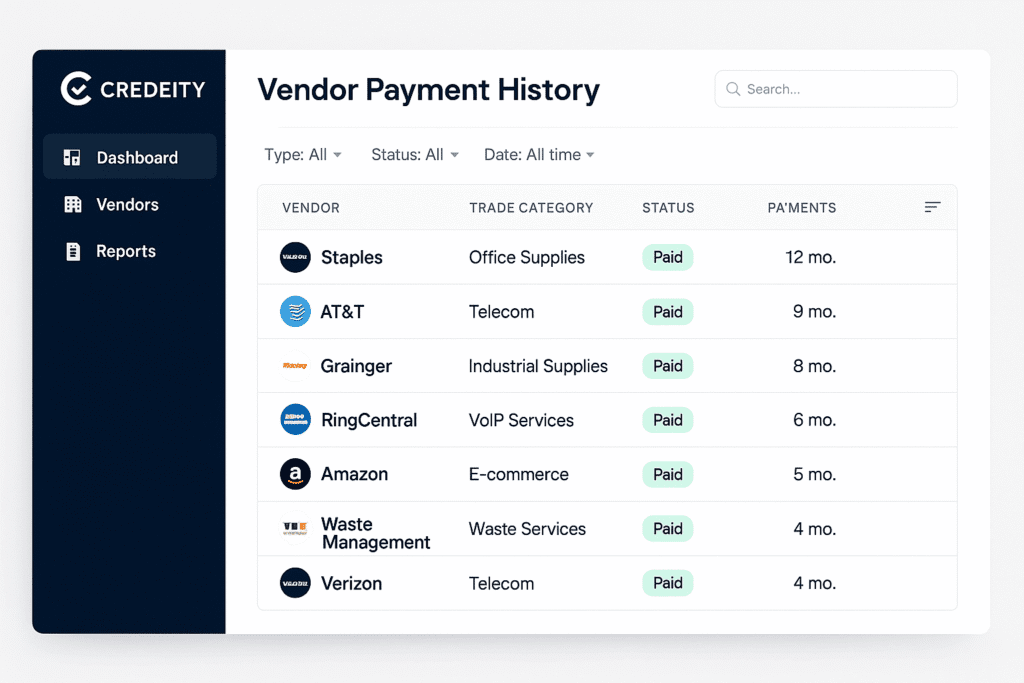

Transparency Into Vendor Behavior

SMBs gain visibility into payment consistency and historical behavior, enabling more confident planning and operations.

Industry Trust

Trusted by vendors across:

Manufacturing

Precision suppliers, machinery providers, fabrication partners, and OEM distributors.

Wholesale

Distributors, supply houses, inventory vendors, food & beverage wholesalers, and B2B product suppliers.

Construction

Material suppliers, equipment rental partners, subcontractor vendors, and building service providers.

Logistics

Freight carriers, delivery contractors, fleet service vendors, and warehousing partners.

Industrial Services

Maintenance vendors, equipment servicing companies, safety suppliers, and on-site service contractors.

Commercial Trades

HVAC, electrical, plumbing, janitorial, property maintenance, and specialty trade vendors.

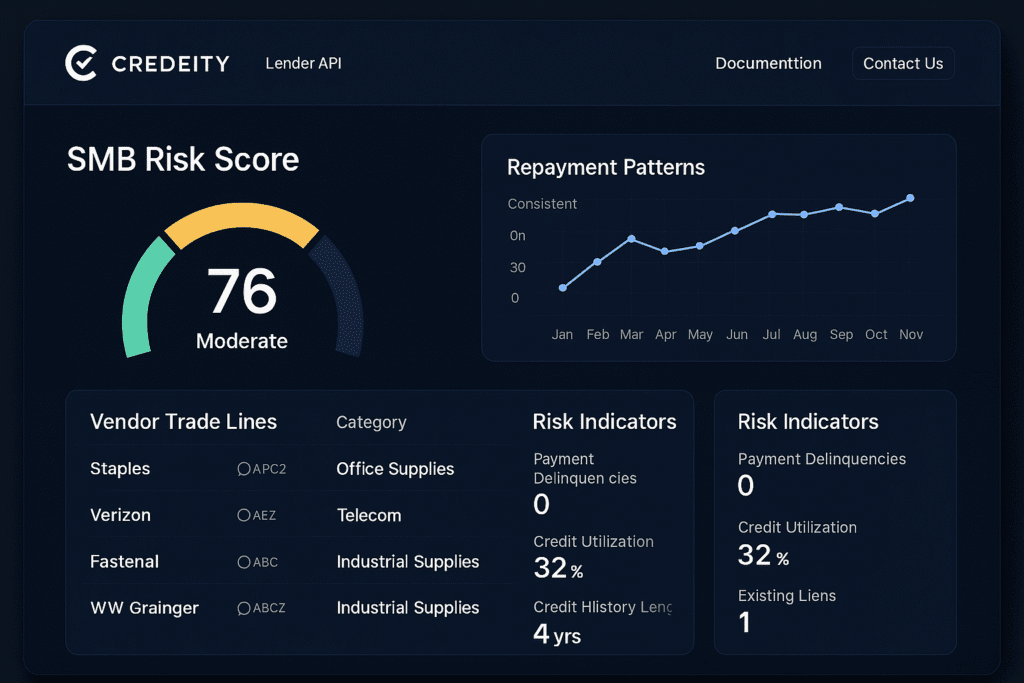

What Credeity Verifies

Credeity verifies key payment signals to generate standardized reliability insights.

Reliability Score

Payment Behavior Trend

On-Time Payments

Consistency

Verified Payments

Value for Vendors & SMBs

For Vendors:

• Improve customer payment consistency

• Strengthen loyalty with credit-building tools

• Reduce credit risk

• Offer differentiated value

For SMBs:

• Build real business credit

• Improve access to loans

• Reduce reliance on personal guarantees

• Unlock financing opportunities

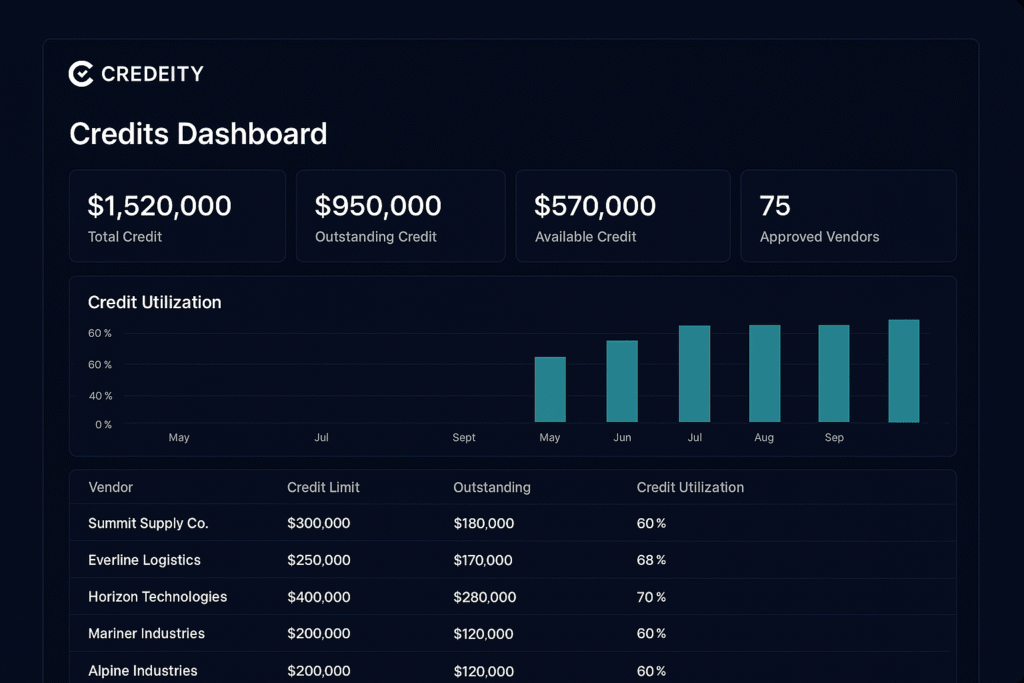

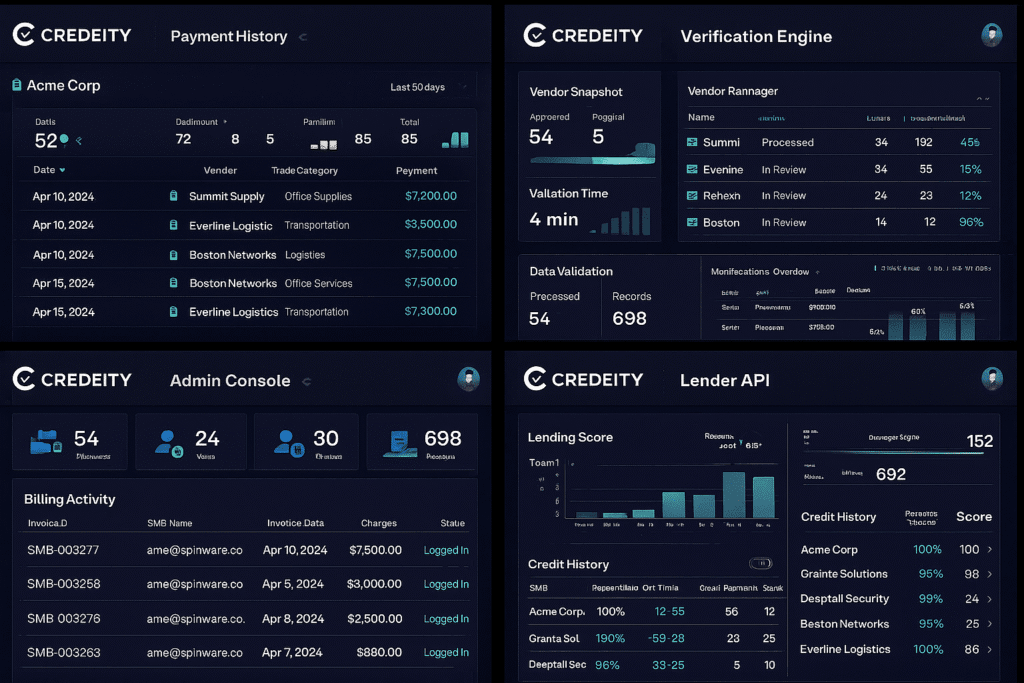

Platform Features

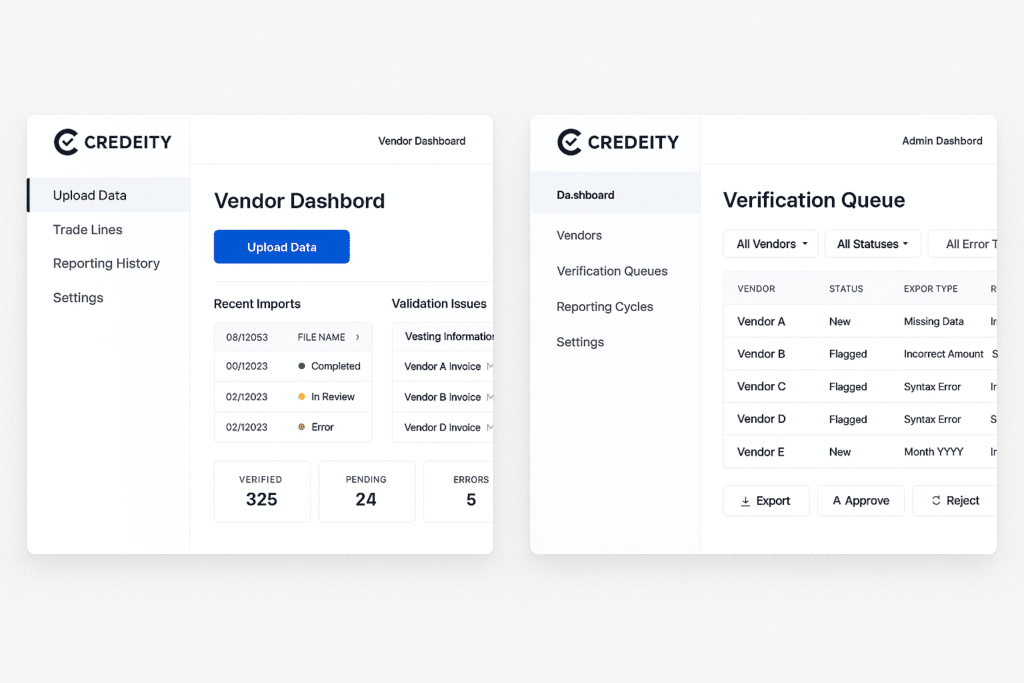

Automated Payment Reporting

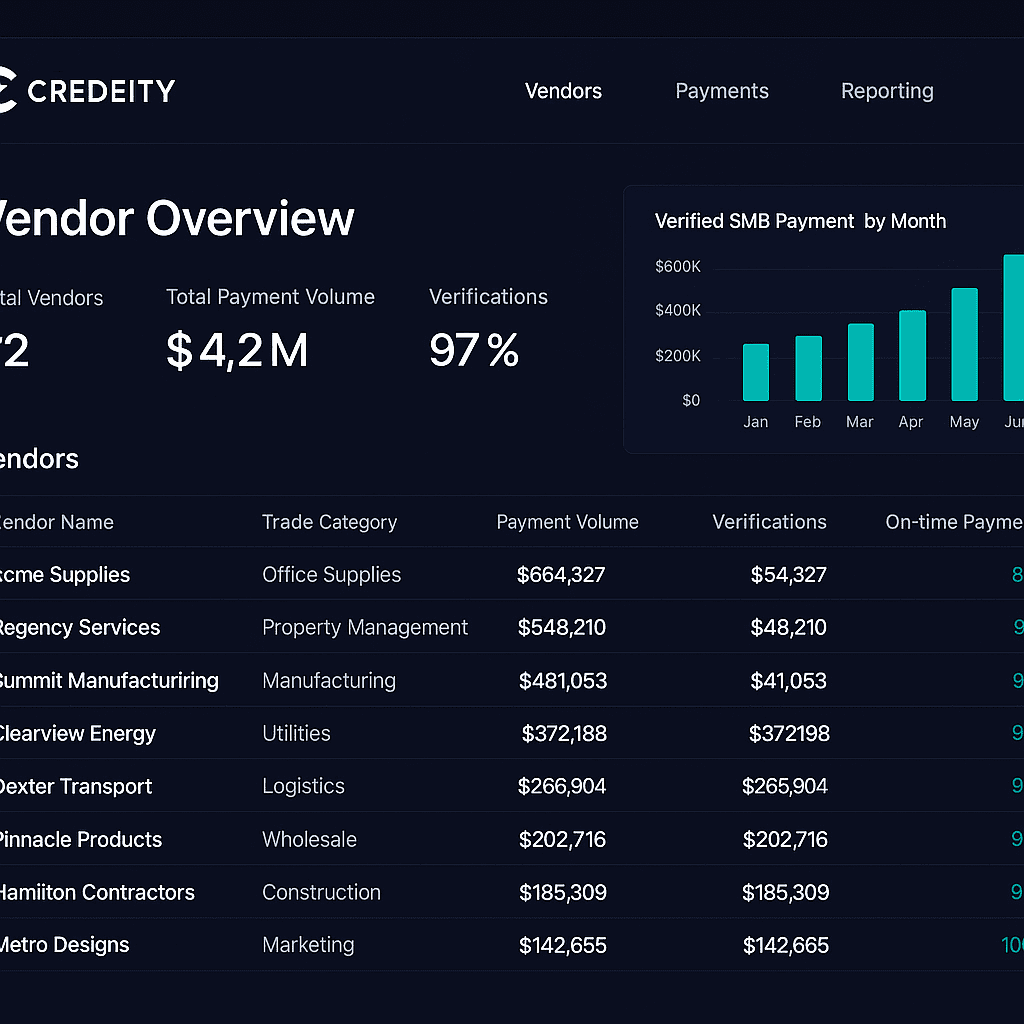

Vendor Intelligence Dashboard

Multi-Bureau Formatting

Identity + EIN Matching

SOC2-Aligned Security

Audit Logging

Product Preview

A Clear View of Customer Payment Behavior

Ready to Get Started?

Help SMBs build verified business credit while improving your payment performance.